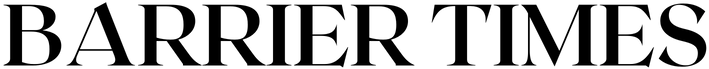

While mainland Auckland property values plummeted, homeowners on picturesque Great Barrier Island are about to be slammed from a staggering 38% average increase in their Capital Values (CVs) – the highest jump across the entire Auckland region.

The eye-watering surge means Island residents face a disproportionately brutal hike in their rates bills, even as most city dwellers enjoy a reprieve.

The long-awaited (and much-delayed) Auckland Council valuations, finally released this morning, have sparked fury among some Island residents. While the average residential property across Auckland saw its value drop by a cool 9% since the last valuation in 2021, the approximately 800 properties on Great Barrier Island have defied gravity with an astonishing upward swing.

Check your new Capital Value online at the Auckland Council website.

Local Board chair Izzy Fordham told AoteaGBI.news: “It’s fair to say that the increase to our property CVs has taken us all by surprise with such a hefty hike as our property values are brought more into line with the rest of the Auckland region.”

She added: “Needless to say, this will have some impact on our rates and if people are concerned, want further information or how to object or seek support for their rates please contact our local Service Centre in Claris. The staff there will be able to assist you, and this should be your first port of call as they have direct contact with Council’s rates team.”

You have the right to object to your new CV if you believe it is incorrect. The window for objections is open from today until July 25.

AoteaGBI.news understands that the radical revaluation on the Island has been heavily influenced by recent, uncommonly high-value sales of at least three super-luxury properties, including vast stretches of waterfront farmland spanning hundreds of acres. The exceptional sales, reaching into the tens of millions, appear to have radically skewed the CV pricing for the entire island, dragging all values upwards.

One distraught resident, who contacted AoteaGBI.news, vented their frustration: “This is insane. A couple of massive properties on the east coast sell in the rateable period, and the whole lot of us are set to be absolutely pummelled.”

“We have the lowest wages in all of Auckland, and will get smashed by the highest rises of anywhere. F****** mental!” they wrote.

The stark contrast to the rest of Auckland is set to hit Island pockets hard. Auckland Council chief finance officer Ross Tucker confirmed the grim reality: “Owners of properties whose value change fared better than the average 9% drop would pay more in rates.” Owners of properties that fared worse than the average drop would pay less.” he said.

With Great Barrier Island’s values soaring while most of Auckland’s residential market declined by 9%, the swing for Island ratepayers will be even more brutal. While the council’s overall household rate increase is 5.8%, the change in values redistributes the burden; those on Aotea will now bear a significantly larger slice of the rates pie.

Many inner-city suburbs like Mt Albert, Ponsonby, and Herne Bay, have seen their valuations fall by about 14%, meaning they will likely see their rates increase by less than the 5.8% average – a bitter pill for Island residents to swallow. Areas like Māngere and Henderson also saw large value declines.

Nick Goodall, head of research at CoreLogic, described the new CVs as “old news” in terms of reflecting current market values, but crucially noted, “For those who want to understand how it flows through to their rates, then [the new CVs are] really important.” His assessment underscoring the direct impact of these new valuations on household budgets, rather than as a guide for buying and selling.

Auckland Council maintains that the CVs are solely for the purpose of “fairly sharing” the rates burden, not for estimating current market values or for mortgage and insurance purposes.

The extreme swings in valuation between 2021 and 2024 are partly attributed to the dramatic economic cycle. As Council’s chief economist Gary Blick explained, the 2021 valuations reflected a market peak with an all-time low Official Cash Rate (OCR) and “exceptionally low mortgage rates.” Fast forward to 2024, and valuations are set against an OCR lifted to a recent high of 5.5%, leading to “higher interest rates [that] cooled buyer demand, leading to a decline in property prices.”

While the overall average residential CV dropped 9%, commercial fell 5%, industrial rose 5%, and rural and lifestyle properties saw a modest 4% increase, Aotea / Great Barrier Island stands alone with its extraordinary 38% leap. Even storm-hit Muriwai saw property values rise by 12%, while Sandringham dropped 16% and Henderson 10%.

Island property owners are urged to review their new valuations carefully. Thankfully, there is a silver lining: you have the right to object to your new CV if you believe it is incorrect. The window for objections is open from today until July 25.